Dear Clients and Friends,

The Employer Health Tax (EHT) is a payroll tax on remuneration, such as salaries, wages, bonuses, taxable benefits, or stock

options, that employers in Ontario provide to current and former employees. The purpose of this tax is to assist in providing

the government with revenue to fund health care in Ontario.

Who is liable for EHT?

You must pay EHT if you have employees who either:

- physically report for work at your permanent establishment in Ontario, or

- are attached to your permanent establishment in Ontario, or

- do not report to work at any of your permanent establishments (for example, they work from home) but are paid from or through your Ontario permanent establishment

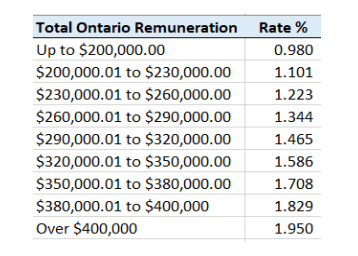

EHT tax rates vary depending on payroll totals. The most recent rates per the Ontario Ministry of Finance are as follows:

If your Ontario payroll exceeds your allowable exemption amount, you will have to pay EHT.

What is the EHT exemption?

The Ontario government has increased the EHT exemption amount to $1,000,000.

You can claim the tax exemption if the following are met:

- you are an eligible employer as defined under the EHT Act

- you pay income taxes

- your Ontario payroll for the year (including the payroll of any associated employers) is less than $5,000,000 or you are a registered charity

- you are not under the control of any level of government

- your board of directors does not include any municipal representatives

For example, if you are an eligible employer with a total Ontario payroll of $1,800,000 per year, you would claim the EHT tax

exemption on the first $1,000,000 and pay EHT on the remaining $800,000 of your payroll for the year.

How does the EHT exemption impact associated employers?

If you are a member of an associated group of employers at any time during the year, and are eligible for the exemption, you must have an agreement to allocate the $1,000,000 exemption amount among the group. You must not claim more than your allocated portion of the exemption amount for the year. If the combined total Ontario payrolls of the members of the associated group exceed $5,000,000, none of the members of the associated group are entitled to an EHT exemption.

Associated employers are connected by ownership or by a combination of ownership and relationships between individuals. The rules for associated corporations under the Income Tax Act are used to determine whether or not employers are associated for EHT purposes. Although these rules refer to corporations, their application is extended under the EHT Act to include individuals, partnerships, and trusts.

Clearhouse LLP can assist in determining whether you as an employer are required to pay EHT, eligble for the EHT exemption, and associated with other entities for EHT purposes.

Please do not hesitate to contact us at info@clearhouse.ca or (647) 969 7382 if you have any questions.